Contributed By Jodie Norquist, CIP, CHSP

Ascensus

If your financial organization is like most across the country, your team has been fielding questions from IRA owners since the SECURE 2.0 Act of 2022 was signed into law on December 29, 2022.

And those phone calls keep coming.

Our ERISA consultants have been just as busy answering your questions on our 800 Consulting Lines. And while the SECURE 2.0 Act contains more than 90 retirement-related provisions, most of your questions involve the age delay for required minimum distributions (RMDs) for IRAs and other retirement plan accounts.

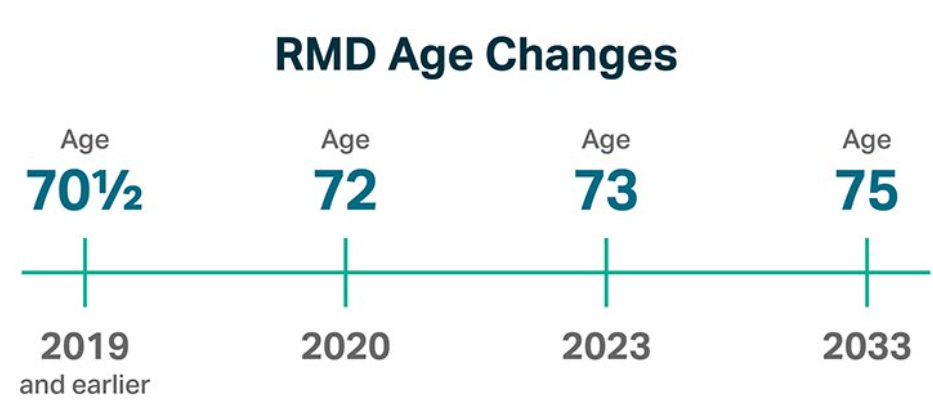

The SECURE Act of 2019 increased the RMD age from 70½ to 72 years. Now the SECURE 2.0 Act of 2022 is once again delaying the RMD age—from 72 to 73—starting in 2023. And wait, there’s more. In 2033, the RMD age will increase to age 75.

Since this new law became effective as of January 1, 2023, the confusion is understandable. Plus, you may have already sent out RMD statements to your clients to let them know they have an RMD due this year. What do you do about those RMD statements sent to account owners who turn 72 this year—and who no longer need to take an RMD? What if a client takes a distribution this year when it isn’t required?

What the Age 73 Increase Means for Your Clients

IRA owners who turn 72 in 2023 (those born in 1951) do not have an RMD due this year. Instead, they will need to start taking RMDs when they attain age 73 in 2024. This RMD must be satisfied before their new required beginning date (RBD) of April 1, 2025. They should keep in mind that if they choose to delay distributing their RMD until 2025 but before April 1, 2025, they will have two RMDs to withdraw in 2025. Their 2025 RMD must be distributed by December 31, 2025.

EXAMPLE: John, a Traditional IRA owner, turns 72 on May 18, 2023. Because SECURE 2.0 delays RMDs until an account owner is 73, he no longer must withdraw an RMD for 2023. His previous RBD would have been April 1, 2024. Instead, John’s first distribution year is next year, when he turns 73. So John must take his 2024 RMD by April 1, 2025. If he delays his 2024 distribution until 2025, he still must take his 2025 RMD by December 31, 2025.

Account owners who turned 72 in 2022 must continue to distribute their 2022 RMD no later than April 1, 2023. The new law is effective in 2023 and doesn’t apply to individuals born in 1950 or earlier who have RMDs due for 2022 and later years.

EXAMPLE: Alicia turned 72 on February 18, 2022. She has yet to take her RMD for 2022 because she knew she could wait until her RBD, which is April 1, 2023. She just learned about the new RMD age delay and wonders whether the new rule applies to her because she turns 73 this year. Since the SECURE 2.0 Act provision is effective as of January 1, 2023, it doesn’t apply to individuals who turned 72 in 2022. So they, like Alicia, will have to take their RMD by April 1, 2023, if they have not done so already. They will continue to have a 2023 RMD to withdraw by December 31, 2023.

Note: Remember that some qualified retirement plans (such as 401(k) plans) allow participants who are not 5 percent owners to delay their first RMD year until the year they retire.

What the Age 73 Increase Means for Your Financial Organization

The SECURE 2.0 Act and the IRS have not specifically addressed how financial organizations should handle this RMD age increase for 2023. And as you know, you must provide RMD statements by January 31 to your Traditional and SIMPLE IRA owners. But many organizations were well down the path to sending out these statements when the new law was passed.

So if you haven’t yet mailed out your RMD statements, try to pull the mailings for those born in 1951— who are turning 72 this year. For those who cannot do this or who have already sent the RMD statements, Ascensus advises sending a follow-up letter to these affected individuals, letting them know they no longer have an RMD due this year because of the new SECURE 2.0 Act.

Your IRA owners may still wish to take a distribution, even though an RMD is not due for them this year. They can always withdraw funds from their IRA. But what if they take a distribution this year, mistakenly thinking that it was their RMD? As long as IRA owners haven’t done a rollover with any of their IRAs in the last 12 months, they have 60 days to roll the assets back into their IRA. While IRA owners cannot roll back an RMD into their IRAs, this amount is technically not an RMD since an RMD is not due for them in 2023 because of the law change.

Still Have Questions?

You’re not alone. With passage of the SECURE Act of 2019, the release in 2022 of proposed RMD regulations, and the passage of SECURE 2.0 Act of 2022, the retirement industry has experienced unprecedented changes in the past three years. We have heard your questions—and have come up with some of our own, as well. As our team analyzes these provisions and reaches out to our governmental sources for further interpretation, we anticipate that the IRS will continue to release additional guidance as many of these law changes are implemented.

In the meantime, subscribe to our news updates and to our monthly The Link newsletter where we will keep you updated on the latest IRS guidance. Keep calling our 800 Consulting Lines with your questions. We’re here to help.